Wise Giving Wednesday: The Number of U.S. Charities

Each year the U.S. Internal Revenue Service produces a Data Book that provides information and statistics about returns filed, taxes collected and related issues such as data on tax-exempt organizations. The 2018 Data Book which was released several months ago includes a table which shows the number of tax-exempt organizations. There are 20 different categories that fall under section 501(c) of the Internal Revenue Code which includes various types of organizations (including, but not limited to, labor unions, lobbying organizations, business leagues, recreation clubs, fraternal groups, benevolent life insurance companies, etc.). For 2018, the IRS reports that the combined total number of organizations under this 501(c) category was 1,682,091.

The largest of these categories in terms of the number of organizations, is section 501(c)(3) which covers charitable organizations. The IRS reports that in 2018 there were 1,327,714 organizations that were included in this 501(c)(3) charitable tax-exempt status. That total represents 78% of the combined total number of 501(c) groups referenced above.

The actual total number of charities in the U.S., however, may be a bit higher than 1,327,714 for several reasons:

- Houses of worship (churches, synagogues, mosques, etc.) are not required to file for 501(c)(3) status in order to have charitable tax-exempt status. It is estimated that there are about 350,000 religious congregations in the U.S.

- If an organization that operates under the IRS definition of a charity has gross revenue of less than $5,000, it is not required to apply for 501(c)(3) in order to have this charitable tax-exempt status.

- Some organizations may fall under a group exemption letter held by a parent organization.

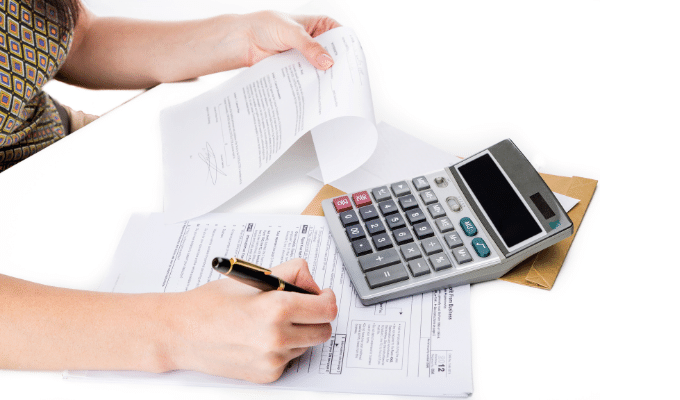

While that 1.33 million total is huge, keep in mind that most of these charities are very small. More than half of them bring in $50,000 or less and do not fill out the IRS Form 990. Instead, they complete the IRS Form 990-N which is a type of electronic postcard that confirms they continue to operate. The remainders complete either IRS Form 990-EZ (gross income between $50,000 and $200,000) or the full IRS Form 990 ($200,000 or more in gross revenue.) Also this group includes about 87,000 private foundations (in general, these are private or corporate foundations that give out grants and do not solicit) which complete the IRS Form 990-PF.

Finally, the total number of charities has been growing. As shown in the IRS Data Book for the past five years, the total average gain in the number of 501(c)(3) organizations has been about 42,000 charities per year. This average increase incorporates newly formed organizations and reflects subtractions of those that have either lost their exempt status or ceased operations:

Number of 501(c)(3) tax-exempt charities

2014 1,117,941

2015 1,184,547

2016 1,237,094

2017 1,286,181

2018 1,327,714

While some may view this growth as creating a challenging choice for donors, others see the size of this sector as an asset that generates new ideas and approaches to problems and issues facing society. In turn, we believe the 20 BBB Standards for Charity Accountability provides helpful guidance for both new as well as existing charities and helps donors identify trustworthy organizations.

Video of the Week

As part of our Building Trust Video Series, we are pleased to provide a video of Laurel Lyle, Vice President, Development, Operations and Fundraising Programs at Cure Alzheimer’s Fund (a BBB Accredited Charity) that seeks to accelerate research and focus exclusively on finding a cure for Alzheimer’s disease. The organization supports research projects that pursue a deeper understanding of the mechanisms of action of the genes and variants with the biggest impact on risk and timing of Alzheimer's disease.

Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going to give.org/charity-inquiry if you are interested in seeing a report on a charity not on the list and we will do our best to produce one

H. Art Taylor, President and CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)