Wise Giving Wednesday – Building Trust Part 11

Two years ago, when the BBB Wise Giving Alliance was one of the co-signers on The Overhead Myth letter, more than one charity executive approached me with the mistaken impression that we were no longer using expense ratios in our charity evaluations. That wasn’t the case at all. As explained in the letter, we urged the donating public not to solely consider financial ratios in making their giving decisions and to look at a more complete picture of a charity’s accountability. We still strongly believe that today as reflected in the diversity of issues covered by the 20 BBB Charity Standards. Overall, we are seeking to ensure that the charity is spending its funds in accordance with donor expectations as expressed in its fund raising appeals.

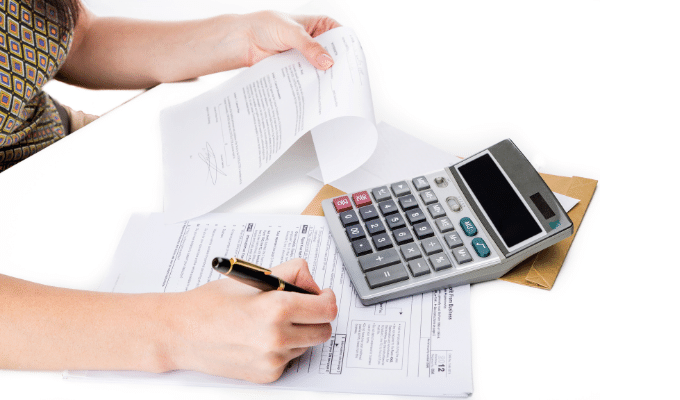

As identified in BBB Charity Standards 8 and 9, we have specific expense thresholds that we verify as part of the financial analysis of our accreditation assessments. Specifically, our standards call for:

- Total program service expenses to be at least 65% of total expenses, and

- Total fund raising expenses not to exceed more than 35% of total related contributions (i.e., donations received as a result of fund raising efforts).

While I will probably devote more than one blog to this subject, there are a few major points about these two standards that I would like to explain. First, in applying both of these standards we look at a full year’s worth of expenses, not just an individual fund raising campaign. Another significant issue is that both of these standards serve as threshold verifications. In other words, as long as the subject charity satisfies these minimums, our report does not make any judgment about the charity’s expense ratios. The third point is that we generally use the charity’s audited financial statements, as opposed to the IRS Form 990, when completing the financial part of our standards. In our view, the audited financial statements provide a more reliable and accurate presentation of the charity’s finances, in part, because they are required to follow Generally Accepted Accounting Principles (GAAP) which helps ensure that the statements are consistent, complete and more comparable.

Please also recognize that the two cited ratios above have different denominators. The program ratio is based on total expense while the fund raising ratio is based on total contributions.

Also, BBB WGA will consider extenuating circumstances that the charity brings to our attention in applying these standards (for example, the higher fund raising expense of a newly created organization). Each charity is reviewed on a fact circumstance basis.

On a separate note, as part of our Building Trust Video Series we are pleased to provide a video that features Robert Lee Bull Jr, Chief Development Officer of the National Trust for Historic Preservation (a BBB Accredited Charity). Robert provides a brief overview of the National Trust’s program activities and explains what they do to help strengthen donor trust.

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going to https://give.org/ask-us-about-a-charity1/ if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

H. Art Taylor, President & CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)